Drop off your CV

We serve the global HR community through our offices located in Delhi, Hong Kong, London, New York, São Paulo and Singapore and have placed HR leaders in over 30 countries.

As we reach the midpoint of 2023, we have seen the HR recruitment sector marked by unpredict...

As we reach the midpoint of 2023, we have seen the HR recruitment sector marked by unpredictability globally.

As specialists in this field, and from our observations and conversations with our HR network, it’s evident that the HR job market has witnessed consistent levels of activity. However, it’s also important to acknowledge that caution has prevailed due to various mitigating circumstances, in particular economic factors.

A number of high profile organisations announced restructures which created significant layoffs with the technology sector being heavily impacted in particular. Where we have noted caution in the market, in part this has also meant that Candidates can be harder to entice to move roles in comparison to the post Pandemic market.

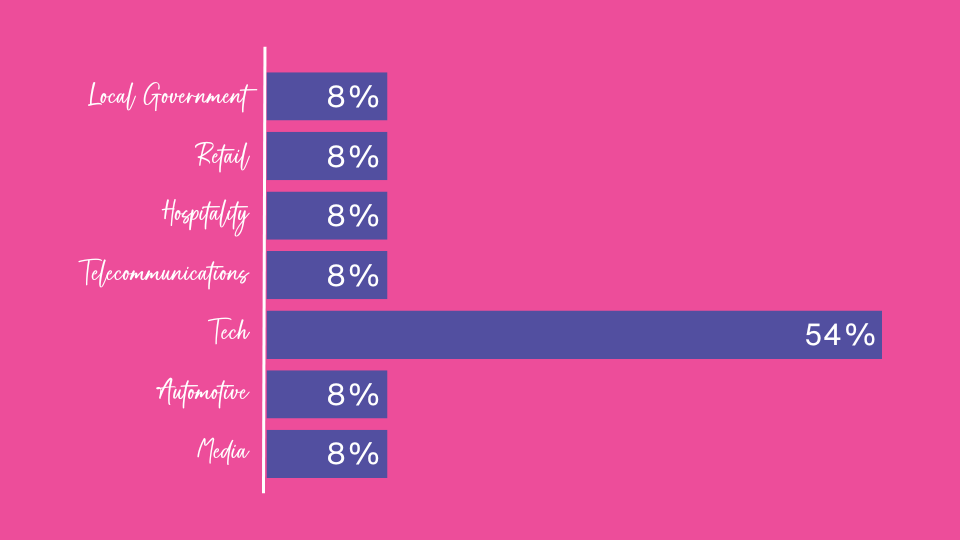

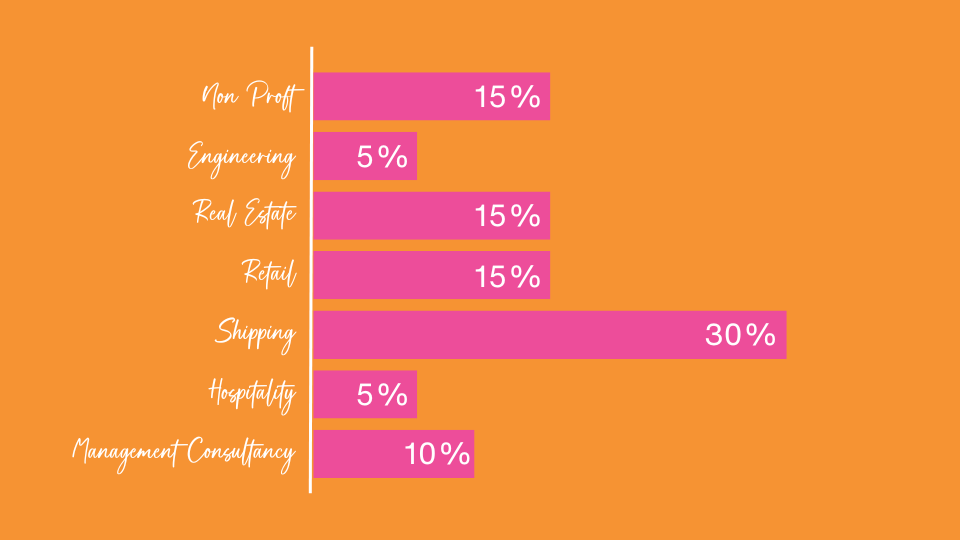

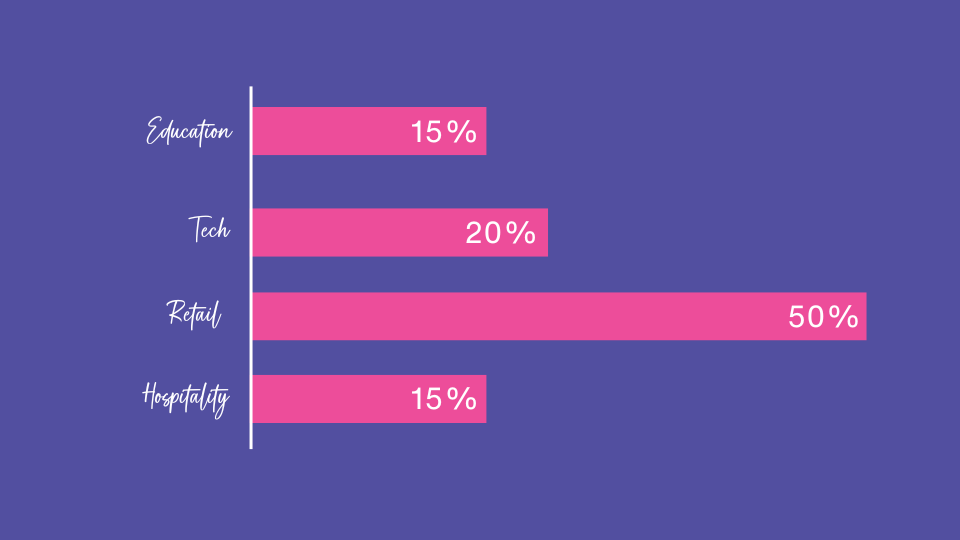

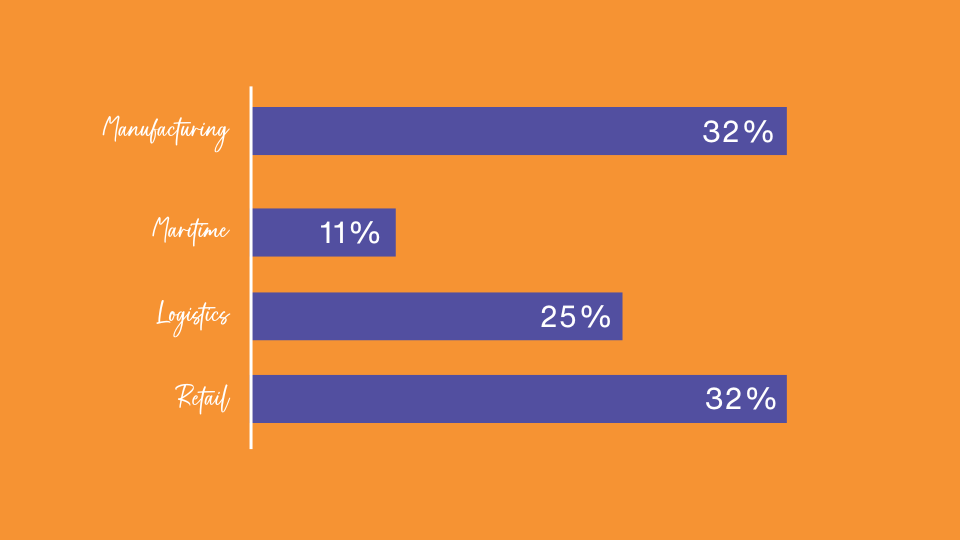

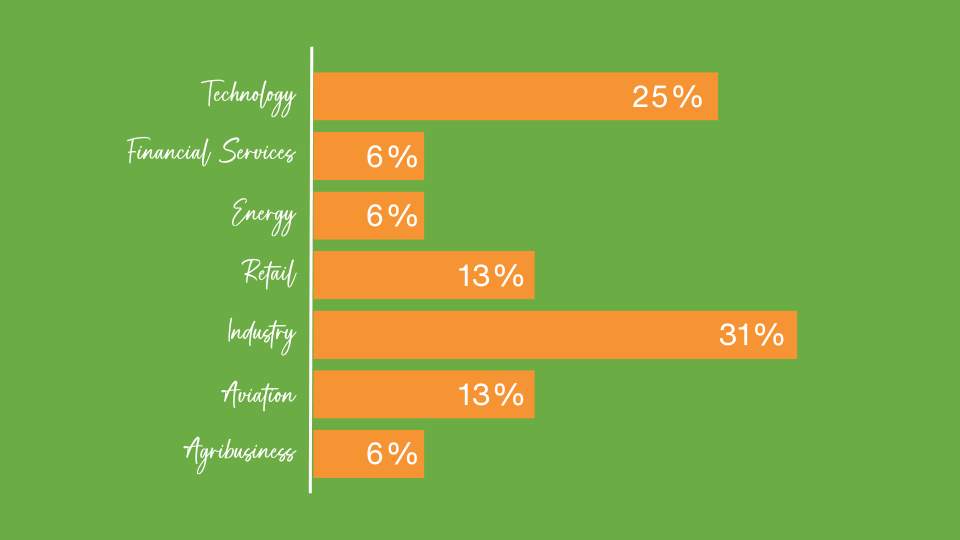

To provide you with a comprehensive overview of the Commerce market to date in 2023, we have compiled insights from our global team of specialist consultants. Below we delve into the trends, challenges, and opportunities shaping the industry. Including a visual showcasing where our regional teams have seen their vacancies in H1 by sector.

UK & Europe

UK:

Heading into H1 of this year, the Commerce and Industry market in the UK was marked by caution. The Office for National Statistics reported a decline in the estimated number of job vacancies overall with a decrease of 55,000 between February and April, bringing the total to c1,100,000. This downward trend persisted for the 10th consecutive quarter, reflecting the prevailing uncertainty across various industries.

We believe that this was driven partially by the excessive hiring in 2021. With the economic landscape not continuing with the upwards trajectory post Pandemic, businesses looked towards headcount and cost reductions in the first half of this year.

In the UK, despite restructures across many big tech firms and start-up businesses. We saw movement in the legacy tech spaces, with more established businesses, gearing for global transformation often focussed on efficiencies and effectiveness.

Our clients have been seeking individuals with robust skills in HR change management, transformation, and organisational design and effectiveness. As businesses strive to adapt and remain agile in response to the constantly evolving market. Another area that remains in high demand is HRIS, as the emphasis on data quality remains central to ongoing transformational efforts.

We have seen movement in hyper growth tech, automotive, legacy media, and online fashion sectors. For these organisations, amongst the requirement for specialist roles, having a capable HR leader, with a strong penchant towards innovation, is a high priority.

Additionally, due to the challenges posed by rising living costs and attrition, we have seen a need for individuals specialising in benefits and learning and development (L&D) to support upskilling of current employees.

Consistent with the market, we also saw a decline in Talent Acquisition activity. To support this community, some of whom had been impacted by restructuring. We hosted our first TA Connect event of the year in partnership with Ellie Rich Poole, The Recruitment Coach who offered advice on navigating the market. Talent Acquisition professionals, from across all sectors, came together to share market insights and discuss their challenges. If you would be interested in attending a future session, sign up here.

I released a poll on LinkedIn in Q2 asking HR professionals what trends they wanted to understand most about in 2023. The results in order of interest were as follows: Gen Z attrition, Future Skills, The Future of Work and ESG. As identified as a key topic, I will shortly be releasing a blog focussed on Gen Z attrition.

As we move forward, it is crucial for HR professionals to remain adaptable and embrace innovation. Building the necessary skillsets to navigate the evolving landscape successfully. Slowly but surely the market is regaining confidence. We are seeing a higher volume of HR vacancies and it’s been great to meet with clients and discuss their hiring plans for the rest of the year. From data that we have had access to and insight from the market, the sectors we predict to see growth within include; HealthTec, EdTech, Oil & Gas and Farming.

I’m also excited to have Charlotte Franks joining our UK Commerce team in H2, she will be focussing on Mid to Senior level roles in Real Estate, Pharmaceuticals and FMCG. Be sure to connect with her on LinkedIn.

You can get in touch with Tom Dover on LinkedIn or at td@elliottscotthr.com

Europe:

As an HR Professional, it’s been a new and exciting challenge for me in H1 joining Elliott Scott HR to build out our European Business.

Across the European market, the picture has been similar to the UK. A slowing in Talent Acquisition. With a focus on embedding existing hybrid working and equipping teams for the future of work. In some European countries there has been a culture of long tenure in roles, however, we are starting to see a shift in mindset with interim and short-term roles becoming more frequent; the need to carry out a project or defined piece of work. The word on everyone lips though is ‘transformation’, both within HR and the business. The employee relations environment in parts of Europe remains challenging and so for many HR professionals, their focus has been navigating that environment whilst considering the organisation of the future.

The market however remains buoyant with candidates weighing up multiple new opportunities at the same time. I’ve already found that two elements remain important in this market; staying close to candidates to understand their drivers and being a true partner to clients to truly understand the role, organisation and the culture that will make their opportunity attractive. There is a nervousness in the market of stepping into a new role without fully understanding the landscape.

It’s been a great couple of months discussing all things people related, and building my network, but still utilising my knowledge of the HR specialism!

You can get in touch with Suzanne Atkinson on LinkedIn or at sa@elliottscotthr.com

North Asia, Hong Kong

Now that Hong Kong has abolished the mask mandate, there is a real sense on the ground that things are ‘back to normal.’ This is clearly later than many other regions but there is huge joy that comes from seeing restaurants and bars full once again.

Another positive turning point is the expanding candidate pool we are experiencing, with the increase in candidates returning or open to relocating to the city. With the airport back to 100% capability, Hong Kong is gaining its global appeal once again.

Given that Hong Kong is now open to tourism, we are seeing that the Hospitality and Aviation sectors are active and growing.

In other areas of Commerce we continue to be optimistic that we will see an uptake in the second half of this year. We also saw large scale redundancies in ‘Big Tech’ linked to large scale restructuring across the board where firms are adapting to the new landscape. This however has the potential to create new opportunities and headcount as different skillsets are needed which we are starting to see come through. This is mirroring what our colleagues specialising in the Financial Services sectors are seeing within banking and crypto.

Unfortunately, we are still seeing some trepidation in the current market from both clients and candidates: some clients are not wanting to bring on new hires while the market conditions are unstable, and some candidates do not want to move jobs while there are redundancy risks. Client budgets remain challenging with replacement hires often at lower salary levels, but so far we have seen minimal hiring freezes in place.

Language skills are also now paramount for 90% of hires on the ground. This is all leading to fewer high-quality jobs coupled with a very tight labour market.

We are seeing a great focus on Talent Management (TM), Learning & Development (L&D) and Transformation across all sectors. After last year’s active Talent Acquisition (TA) market, clients are now placing a lot of importance on retention strategies.

Following the global pattern, TA hiring has slowed, whereas engagement and employer branding hiring has increased. We are seeing clients increase their TM offerings through bringing this function inhouse and looking to hire senior individuals to focus on L&D in order to aide retention. This is coupled with an increase in resources being focused on internal culture and Diversity, Equity and Inclusion.

You can get in touch with Alice Cheung and Lucinda Seaton on LinkedIn or respectively by email at: ac@elliottscotthr.com or ls@elliottscotthr.com

North America

In the US, the market remained uncertain from a Talent Acquisition perspective in Q1, with specialist HR roles specifically tailored to employee engagement/retention, faring most dominant. Something to note was the resurgence of ‘contract’ hiring, as we partnered with more companies who saw the benefits of engaging a flexible workforce amid murky economic conditions.

Hybrid working continued to build momentum over ‘remote-first’, across most of the Commerce sector. Within Retail and Hospitality specifically, we are still seeing a huge demand for hourly workforce hiring, given the fallout from pre to post pandemic workforce levels.

Our predictions for Q2 were of a more buoyant talent market, with Total Rewards and Business Partnering being key HR hires. This has been somewhat true, although layoffs and the looming debt ceiling have continued to breed uncertainty. That uncertainty has been evident through inconsistent job creation numbers across the US, with some months surpassing expectations positively, and other months such as June being the lowest job creation statistics since 2020.

However, despite these positive trends we are still facing a similar stalemate regarding hiring. Some key points to note:

- The HR landscape in Q2 2023 witnessed the rise of HR Analytics and Systems roles driven by new HR technology and data-driven approaches.

- Employee Compensation and Benefits have become top priorities, addressing; mental health, financial security, and preventative care in a bid to retain top talent.

- Diversity, Equity, and Inclusion face significant challenges as organizations strive for inclusivity and to address systemic barriers.

For many organizations, hiring has taken a backseat, with the focus on talent development and retention. Overall, the Tech & Ecomm sectors are seeing an uptick in HR re-structuring and transformation, with a focus on technology adoption, holistic employee well-being, and strategic initiatives in shaping the future of work.

You can get in touch with Daniel Orr on LinkedIn or at do@elliottscotthr.com

India

Observing the remarkable growth in H1 2023, the Indian economy has not only thrived steadily but has also solidified its position as a prominent global outsourcing hub. The driving force behind this is a shift in organizational strategies after an era of extensive hiring. In response to the changing landscape, companies have fine-tuned their focus on cost optimization and skill alignment, resulting in significant layoffs. In light of these circumstances, India emerged as a pivotal player, offering a cost-efficient and talent-rich market. It has swiftly become the preferred destination for countries aiming to drive their businesses forward.

Let’s take a deeper dive into the different industries within the Commerce sector -

Starting with Manufacturing, we have witnessed an impressive transformation. Over 54% of organizations have embraced the shift towards automated and process-driven manufacturing, coupled with the strategic implementation of artificial intelligence and analytics in their business operations. Another promising sector is the Pharmaceutical, Healthcare, and Biotech sector, which has attracted increasing levels of investment and is poised for growth in 2023 with focus on quality manufacture, affordability, and innovation.

Another notable sector is the Retail Industry, which makes a substantial contribution of approximately 10% to India's GDP and employs around 8% of the workforce. In April 2023, the industry witnessed a moderate growth rate of 6%. However, it is the luxury segment encompassing cars, retail, jewellery, and high-end fashion that has been experiencing unprecedented growth. This surge can be attributed to factors such as increased disposable income, a flourishing spirit of entrepreneurship, a growing interest from younger generations, and a robust demand emerging from Tier 1 and Tier 2 cities.

Despite the challenges faced during the pandemic, sectors like Hospitality and Aviation are now witnessing a remarkable resurgence, driven by a surge in travellers as the economy expands and incomes steadily rise. This resurgence is evident as the occupancy rate has experienced a noteworthy upswing, soaring from 59% in the previous year to an impressive 66% this year. The Hospitality industry, in particular, has exceeded expectations with its remarkable performance thus far, yet it is not without its own set of challenges. Among these concerns, the rising attrition rate has emerged as a prominent issue for many HR leaders.

India's unwavering green energy vision has propelled remarkable growth in the renewable sector. Green job postings have surged by 81% annually, accompanied by an impressive 64% month-on-month growth. It is a promising shift towards a greener future, where environmental consciousness and economic growth go hand in hand.

Along with industry trend, we have observed some interesting trends in the market like technology advancements, data driven decision making, skills development, and employee well-being.

In conclusion, the future of India's Commerce sector holds great promise. It is fascinating to observe how it will evolve and thrive in H2 this year, fuelled by innovation, strategic investments, and a commitment to sustainable practices

You can get in touch with Rinkal Choudhary on LinkedIn or at rc@elliottscotthr.com

South East Asia, Singapore

The Singaporean economy expanded by 3.2% in 2022 and the Ministry of Trade and Industry maintains a growth projection of 2.5% for 2023. Like other regions, the growing Tech sector has been impacted by the ‘ripple effect’ of layoffs in ‘big tech’ however overall redundancy numbers in this sector remain reasonably low at 1,200 which should be offset by continued hiring by other emerging organisations.

Growth outlook for Aviation and Tourism related sectors remains the most optimistic as Changi Airport increased passenger traffic volumes to 75% of pre-pandemic levels; with multiple new hotels and tourist attractions opening and under construction.

We continue to see the migration of regional HQs or partial migration of regional HQ employees to Singapore from Hong Kong. Whilst this was a definite trend in Banking/Investments from Q3 2022, we are seeing this migration from US listed multi-nationals such as FedEx. Aligned to this trend has been the demand for newly created or located HR roles, typically Regional Head of HR or Regional HRBP, as US or European listed organisations continue to look to the emerging Asian markets to drive revenue growth.

Within hiring, the demand remains for experience in Talent Management/Development to aid retention. We are also seeing an increased demand for Talent Acquisition professionals with experience in developing the employee experience/engagement piece from the pre-employment experience.

You can get in touch with Adrina Kay on LinkedIn or at adk@elliottscotthr.com

LATAM, Brazil

In Brazil, as expected, the HR hiring market in Q1 was slow due to the change of government and the knock-on effect on politics and the economy. As a result, the hiring market focused its efforts on specialized operational positions to maintain their structures and reduce costs. Due to the contraction of the technology market, which historically had grown by around 20% annually, positions such as Business Partners were in lower demand in the hiring market. The GDP in Brazil during this period grew by 1.9% compared to the last quarter of 2022, with growth seen in Agriculture (21.6%), Financial Activities (1.2%) and Services (0.06%).

Like our global peers, we saw the return to the office as a prominent topic. With many companies changing their initial post-pandemic guidelines, removing remote or hybrid work options from their policies and returning to 100% in-office models. As a result, flexible or remote work models are once again seen in the Brazilian market as a benefit rather than a common and accessible work model for employees.

Q2 started off with more active hiring processes, which is a clear reflection of the market's confidence in the country's political and economic policies. The overall number of filled vacancies increased, prompting companies to also consider their retention mechanisms and policies, leading to a demand for HR professionals in Talent Acquisition and Organisational Development.

Around 66% of the positions we supported our clients with were at an operational level, indicating that companies are confident in their HR leadership. Highlighting companies' need to have a comprehensive view of people-related costs.

During this period, we noticed a tangible decrease in Diversity and Inclusion discussions within companies, which gave rise to the term 'Inclusion Fatigue', reflecting a cooling off of the topic in the corporate world regionally.

The Brazilian GDP continued to grow in Q2, and as a result, we anticipate an increase in hiring levels for Q3.

You can get in touch with Eduardo on LinkedIn or at ebs@elliottscotthr.com