Looking back on the initial quarter of 2024, it's evident that the Indian economy is mov...

Looking back on the initial quarter of 2024, it's evident that the Indian economy is mov...

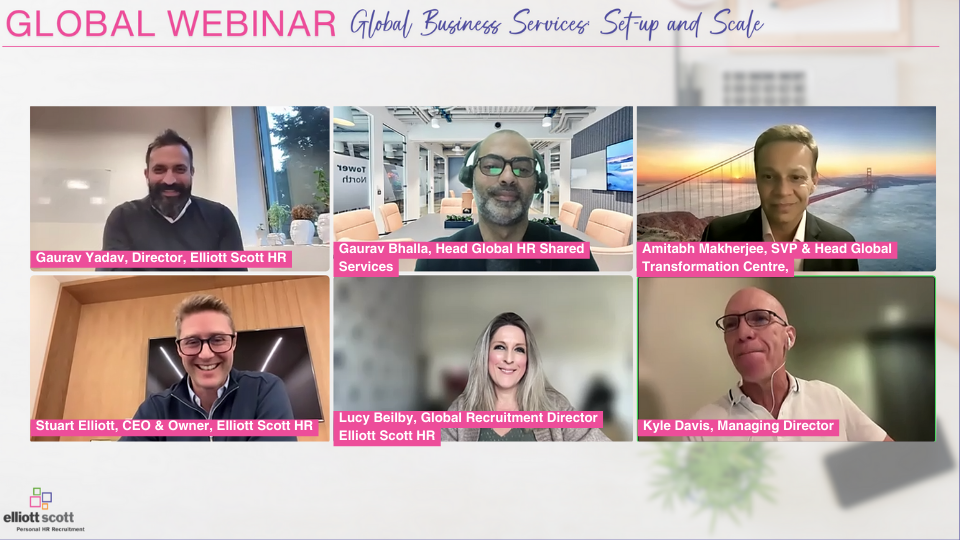

As we approach the end of season 6 we wanted to bring back a topic that has continued to be ...

A well-planned return-to-work program can not only support your employees' wellbeing but...

1:04:01

1:04:01

7:31

7:31